「貨幣政策的十字路口」,無疑是 2025 年最重要的財經議題。繼 2024 年底市場迎來首次降息後,聯準會的下一步棋該怎麼走,變得空前複雜。一方面,經濟成長與勞動市場的動能已顯著放緩,支持決策者繼續降息以支撐經濟;但另一方面,關稅政策等因素卻使通膨壓力再度浮現,讓降息之路充滿變數。

但你知道嗎?在 9 月的利率決策會議之前,8 月底還有一個可能為這片迷霧指引方向的關鍵會議,甚至可能揭示聯準會的最終政策權衡——那就是 Jackson Hole 全球央行年會。讓股感告訴你,為何在 2025 這個充滿挑戰的年度,Jackson Hole 的重要性更勝以往,以及它將如何牽動全球市場的下一步。

編按:2025/08/22 更新,鮑威爾的演講已經結束,在演講中鮑威爾釋出了貨幣政策可能將調整的暗示以及對貨幣政策框架的改動,想看更多的重點摘要以及完整逐字稿請點這裡!

什麼是 Jackson Hole?

Jackson Hole 是一年一度的全球央行年會,由美國堪薩斯聯邦準備銀行於每年 8 月下旬舉辦的年度盛會,也是歷史最悠久的央行會議之一,會議就在 Jackson Hole 這個地方舉行(這是其實是一個地名!), 會議將討論主要國家經濟體的貨幣政策,是受到各國央行關注的盛會,將邀集央行官員、經濟學家、金融市場參與者、政府官員與媒體人員共聚一堂,探討重要的長期政策,會後將發布會議記錄提供給全球人士參閱。

2025 年 Jackson Hole 會議主題

今年 Jackson Hole 在 8 月 21 日至 23 日舉行,將聚焦在「勞動市場的轉型:人口結構、生產力與總體經濟政策」(Labor Markets in Transition — Demographics, Productivity and Macroeconomic Policy)」。 Fed 主席 Powell 於 8 月 22 日美東時間上午 10:00(台北時間晚上 10:00)發表主體演講。

Jackson Hole 對股市的影響

Jackson Hole 無疑是 8 月最重要的大事,因為本場會議內容探討的貨幣政策,涉及到全球總體經濟發展,將決定全球經濟的走向,故會議內容及那位一句話就能撼動股市的男人- Powell 表述的內容,將深深影響股市。

筆者回測歷史數據發現,Jackson Hole 會議前後 5 個交易日,美股大盤的震盪幅度會放大,那該如何應對 Jackson Hole 的到來呢?筆者實際回測 2020~2024 年的數據,分析並提出建議給讀者參考。

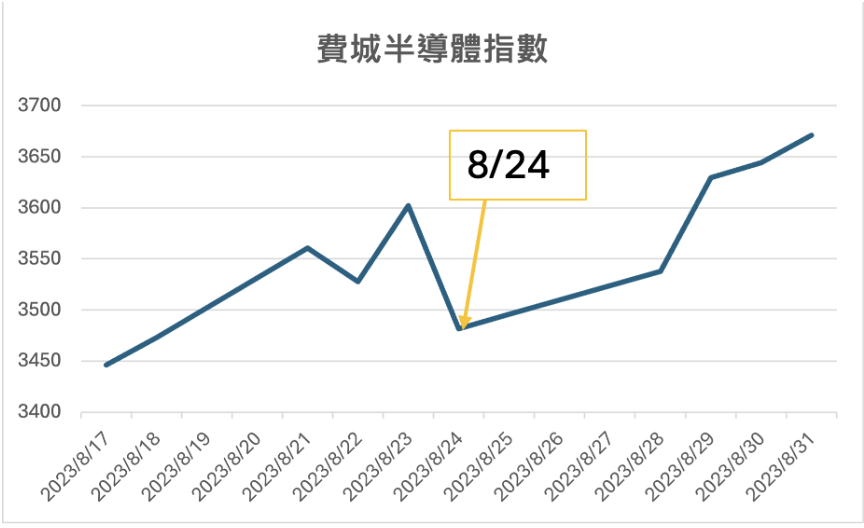

2023年,8/24~8/26

在會議前下跌修正,在會議的第一天來到相對低點,後續回歸正常交易格局,並再度上漲。

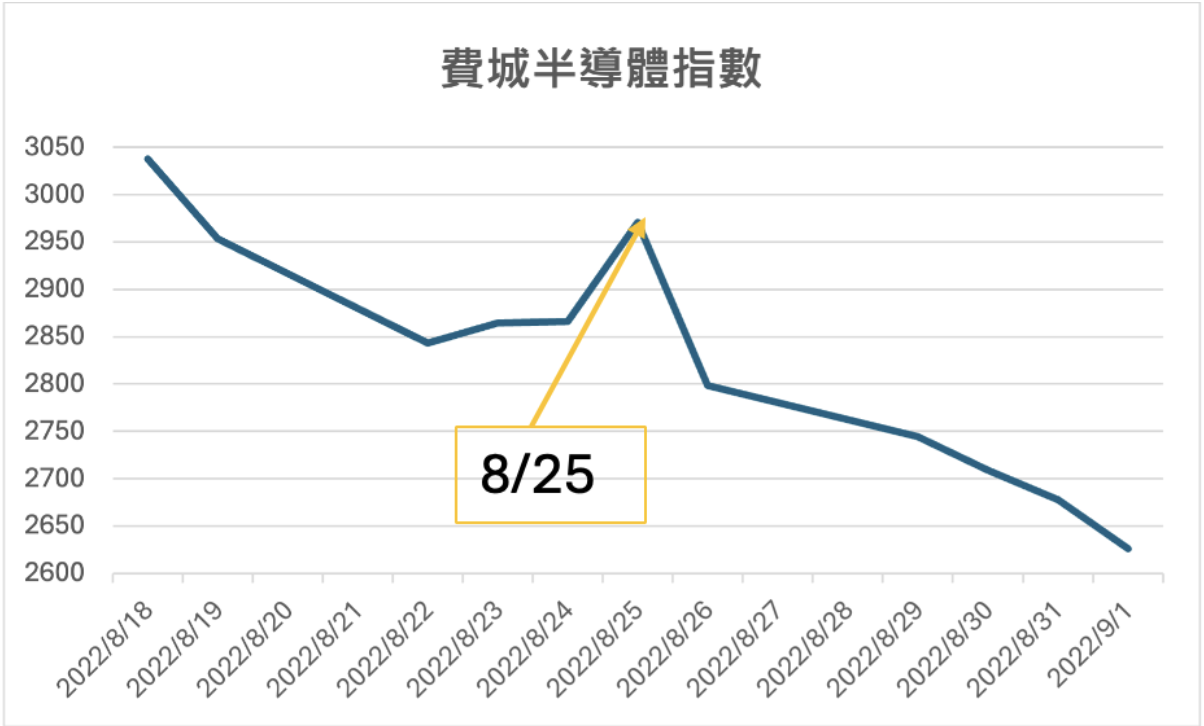

2022年,8/25~8/27

在會議前上漲,在會議的第一天來到相對高點,後續出現下跌趨勢。

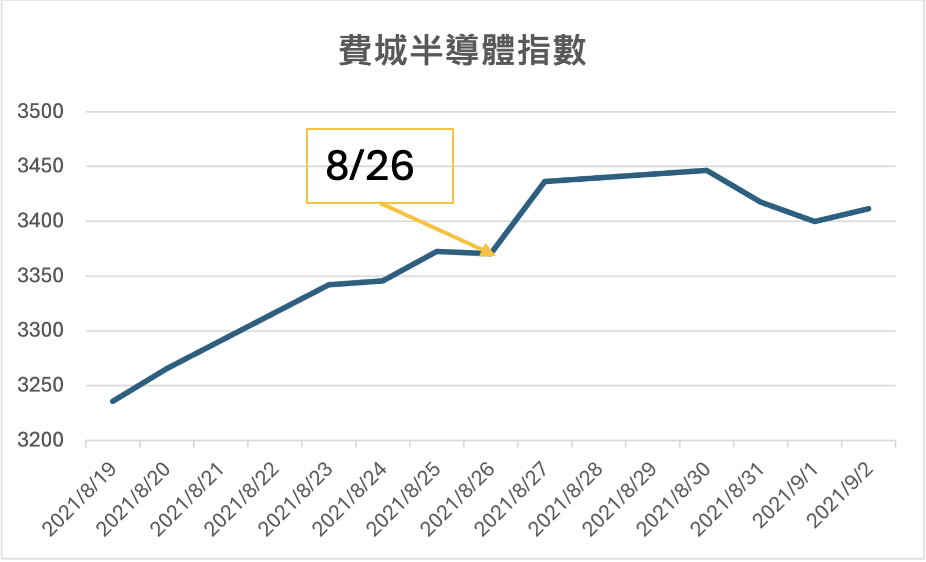

2021年,8/26~8/28

會議前上漲趨勢放緩,在會議的第一天後,再度上漲一個小波段。

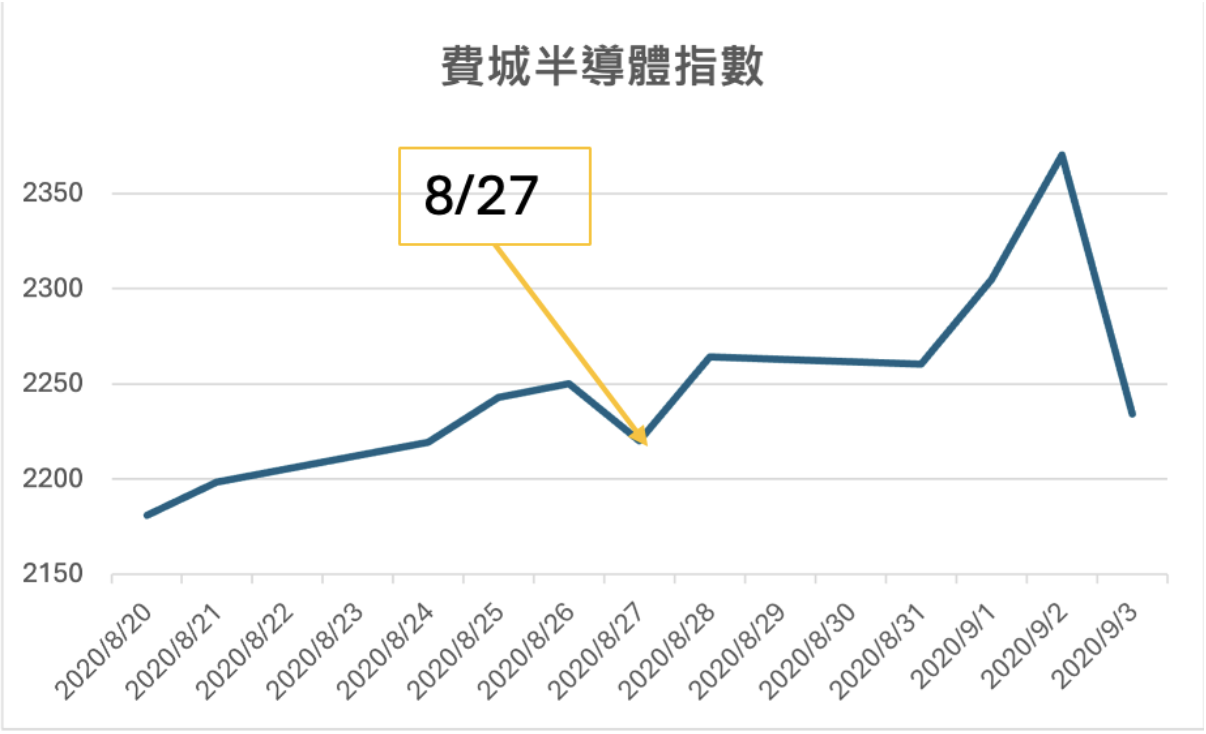

2020年,8/27~8/28

在會議前緩步上漲,在會議的第一天出現下跌,但後續再有一波上漲波段。

回測數據小結

觀察 2020~2023 年的費城半導體走勢,除了 2022 年是因為當年 FED 啟動暴力升息循環,當時的時空背景是投資機構認為說,Powell 會在 Jackson Hole 會議釋放暫緩升息的鴿派消息,結果 Powell 仍持鷹派看法,強調會持續升息,因此費城半導體一路續跌。

若排除 2022 年,在 2020、2021、2023 年這三年中,雖然走勢不完全相同,但可以看出一個規律,在會議前若是上漲波段的趨勢,當時間越靠近 Jackson Hole ,上漲幅度會放緩或出現下跌修正,因為市場擔心會有不確定的利空消息出現,但在 Jackson Hole 的第一天會議結束後,市場消化不確定的消息,現有的消息已被確定,費城半導體將重回正常交易格局,甚至再有一波上漲波段。

【延伸閱讀】

Powell 的 Jackson Hole 演講內容(中英文逐字稿)

2025 Jackson Hole 重點摘要

- 當前經濟情勢與短期展望:

- 經濟概況:美國經濟今年展現了韌性。勞動市場接近充分就業,通膨雖仍偏高,但已從疫情後的高點顯著回落。然而,經濟面臨的風險平衡正在轉變。

- 新的挑戰:更高的關稅和更嚴格的移民政策正在同時影響總體供給與需求,這使得區分經濟的「週期性」波動與「結構性」變化變得困難,而貨幣政策主要只能應對前者。

- 勞動市場:就業增長已大幅放緩,但失業率仍穩定在 4.2% 的歷史低位。這是一種由勞動力供給(因移民減少)和需求同步放緩所造成的「奇特平衡」。這種情況增加了就業市場的下行風險。

- 經濟增長與通膨:今年上半年GDP增速放緩至 1.2%。與此同時,關稅開始推高部分商品價格,核心個人消費支出(PCE)物價指數年增率為 2.9%。聯準會認為關稅的影響可能是一次性的物價水平轉變,但仍需警惕其引發持續性通膨的風險。好消息是,長期通膨預期仍穩定錨定在 2% 的目標。

- 貨幣政策意涵:短期內,美國經濟面臨「通膨上行風險」和「就業下行風險」並存的挑戰局面。聯準會的政策利率目前處於限制性區間,這讓他們可以謹慎行事。未來的政策調整將完全依據最新的經濟數據及其對前景的影響,沒有預設路徑。

- 貨幣政策框架的演變與修訂:聯準會完成了五年一度的公開審查,並對其《長期目標與貨幣政策策略聲明》進行了幾項重大修訂,以更好地應對多變的經濟環境。

- 修訂背景:2020 年修訂的框架是在一個低利率、低通膨的時代背景下制定的,當時的主要擔憂是利率觸及「有效利率下限」(ELB)。然而,疫情後的高通膨現實表明,過於關注 ELB 的框架在溝通和執行上都帶來了挑戰。

- 四大核心修訂:

- 淡化 ELB 的重要性:新框架不再將 ELB 視為決定性的經濟特徵,而是強調政策策略需適用於「廣泛的經濟狀況」。

- 放棄「彌補」策略:回歸「彈性通膨目標制」(flexible inflation targeting),取消了在通膨低於 2% 後,需在未來一段時間讓通膨「適度高於」2%的「彌補」策略。現在的重點是採取有力行動,確保長期通膨預期被牢牢錨定。

- 重新定義就業目標:2020 年的框架關注於彌補「就業缺口(shortfalls)」,這曾被誤解為聯準會不會對過熱的勞動市場採取預防性緊縮政策。新聲明澄清,雖然就業有時可以在不引發通膨的情況下高於預估的最大值,但如果勞動市場的緊俏威脅到物價穩定,採取預防性行動是必要的。

- 強調「平衡方法」:當充分就業和物價穩定這兩大目標發生衝突時,新框架明確指出將採取「平衡的方法」(balanced approach)來權衡取捨,這與 2012 年的初始框架表述更為一致。

Over the course of this year, the U.S. economy has shown resilience in a context of sweeping changes in economic policy. In terms of the Fed’s dual-mandate goals, the labor market remains near maximum employment, and inflation, though still somewhat elevated, has come down a great deal from its post-pandemic highs. At the same time, the balance of risks appears to be shifting.

今年以來,在經濟政策發生全面性變革的背景下,美國經濟展現出了韌性。就聯準會的雙重使命目標而言,勞動市場依然接近充分就業,而通膨儘管仍然偏高,但已從疫情後的高點大幅回落。與此同時,風險的平衡似乎正在轉變。

In my remarks today, I will first address the current economic situation and the near-term outlook for monetary policy. I will then turn to the results of our second public review of our monetary policy framework, as captured in the revised Statement on Longer-Run Goals and Monetary Policy Strategy that we released today.

在我今天的演說中,我將首先闡述當前的經濟情勢以及貨幣政策的短期展望。接著,我將談到我們第二次貨幣政策框架公開審查的結果,這些結果體現在我們今天所發布、修訂後的《長期目標與貨幣政策策略聲明》之中。

Current Economic Conditions and Near-Term Outlook

When I appeared at this podium one year ago, the economy was at an inflection point. Our policy rate had stood at 5-1/4 to 5-1/2 percent for more than a year. That restrictive policy stance was appropriate to help bring down inflation and to foster a sustainable balance between aggregate demand and supply. Inflation had moved much closer to our objective, and the labor market had cooled from its formerly overheated state. Upside risks to inflation had diminished. But the unemployment rate had increased by almost a full percentage point, a development that historically has not occurred outside of recessions. Over the subsequent three Federal Open Market Committee (FOMC) meetings, we recalibrated our policy stance, setting the stage for the labor market to remain in balance near maximum employment over the past year (figure 1).

一年前當我站在這個講台上時,經濟正處於一個轉折點。當時,我們的政策利率在 5.25% 到 5.5% 的水準上,已經維持了超過一年的時間。這種限制性的政策立場是適當的,它有助於壓低通膨,並促進總體需求與供給之間達成永續的平衡。那時,通膨已大幅朝我們的目標靠近,勞動市場也從先前過熱的狀態降溫,通膨的上行風險已經減弱。

然而,失業率卻上升了將近整整一個百分點——這種情況在歷史上從未於經濟衰退之外發生過。因此,在隨後的三次聯邦公開市場委員會(FOMC)會議中,我們重新校準了政策立場,為勞動市場在過去一年能維持在接近充分就業的平衡狀態奠定了基礎。

This year, the economy has faced new challenges. Significantly higher tariffs across our trading partners are remaking the global trading system. Tighter immigration policy has led to an abrupt slowdown in labor force growth. Over the longer run, changes in tax, spending, and regulatory policies may also have important implications for economic growth and productivity. There is significant uncertainty about where all of these polices will eventually settle and what their lasting effects on the economy will be.

今年,經濟面臨了新的挑戰。針對主要貿易夥伴大幅提高的關稅,正在重塑全球貿易體系。更嚴格的移民政策已導致勞動力增長急遽放緩。長遠來看,稅收、支出和監管政策的變化,也可能對經濟增長和生產力產生重要影響。這些政策最終將如何定案,以及它們將對經濟產生何種持久影響,都存在著重大的不確定性。

Changes in trade and immigration policies are affecting both demand and supply. In this environment, distinguishing cyclical developments from trend, or structural, developments is difficult. This distinction is critical because monetary policy can work to stabilize cyclical fluctuations but can do little to alter structural changes.

貿易和移民政策的變化正同時影響著需求與供給兩端。在這樣的環境下,要區分「週期性」發展與「趨勢性」(或稱「結構性」)的發展,是十分困難的。這種區別至關重要,因為貨幣政策可以發揮作用來穩定週期性波動,但對於改變結構性變化卻幾乎無能為力。

Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.

整體而言,儘管勞動市場看似處於平衡狀態,但這是一種奇特的平衡,其成因是勞動力的供給與需求兩端都出現了顯著的放緩。這種不尋常的情況暗示著,就業的下行風險正在增加。而一旦這些風險成真,它們就可能以裁員大幅增加和失業率攀升的形式迅速出現。

At the same time, GDP growth has slowed notably in the first half of this year to a pace of 1.2 percent, roughly half the 2.5 percent pace in 2024 (figure 3). The decline in growth has largely reflected a slowdown in consumer spending. As with the labor market, some of the slowing in GDP likely reflects slower growth of supply or potential output.

與此同時,今年上半年 GDP 增長已顯著放緩,增速降至 1.2%,大約是 2024 年 2.5% 增速的一半。增長的下滑主要反映了消費者支出的放緩。如同勞動市場的情況一樣,GDP 的部分放緩可能也反映了供給面,也就是潛在產出增長的減慢。

Turning to inflation, higher tariffs have begun to push up prices in some categories of goods. Estimates based on the latest available data indicate that total PCE prices rose 2.6 percent over the 12 months ending in July. Excluding the volatile food and energy categories, core PCE prices rose 2.9 percent, above their level a year ago. Within core, prices of goods increased 1.1 percent over the past 12 months, a notable shift from the modest decline seen over the course of 2024. In contrast, housing services inflation remains on a downward trend, and nonhousing services inflation is still running at a level a bit above what has been historically consistent with 2 percent inflation (figure 4).

談到通膨,提高的關稅已開始推升某些商品類別的價格。根據現有最新數據的估算顯示,在截至七月為止的十二個月內,整體個人消費支出(PCE)物價指數上漲了 2.6%。排除波動較大的食品和能源類別後,核心 PCE 物價指數上漲了 2.9%,高於一年前的水平。在核心指數中,商品價格在過去十二個月上漲了 1.1%,這與 2024 年期間所見的溫和下滑相比,是一個顯著的轉變。相較之下,住房服務通膨仍處於下降趨勢,而非住房服務通膨則依然略高於歷史上與 2% 通膨率相符的水平。

The effects of tariffs on consumer prices are now clearly visible. We expect those effects to accumulate over coming months, with high uncertainty about timing and amounts. The question that matters for monetary policy is whether these price increases are likely to materially raise the risk of an ongoing inflation problem. A reasonable base case is that the effects will be relatively short lived—a one-time shift in the price level. Of course, “one-time” does not mean “all at once.” It will continue to take time for tariff increases to work their way through supply chains and distribution networks. Moreover, tariff rates continue to evolve, potentially prolonging the adjustment process.

關稅對消費者物價的影響現在已清晰可見。我們預期這些影響將在未來幾個月持續累積,但其發生的時間點和影響程度都存在高度不確定性。對貨幣政策而言,關鍵問題在於:這些價格上漲是否可能實質性地提高持續性通膨問題的風險。一個合理的基準情境是,其影響將是相對短暫的——僅是一次性的物價水平轉變。當然,「一次性」不代表「一次到位」。關稅提升的影響仍需要時間才能完全傳導至整個供應鏈和分銷網絡。此外,關稅稅率本身也在持續變化,這可能會延長整個調整過程。

It is also possible, however, that the upward pressure on prices from tariffs could spur a more lasting inflation dynamic, and that is a risk to be assessed and managed. One possibility is that workers, who see their real incomes decline because of higher prices, demand and get higher wages from employers, setting off adverse wage–price dynamics. Given that the labor market is not particularly tight and faces increasing downside risks, that outcome does not seem likely.

然而,也有另一種可能性,就是關稅帶來的物價上行壓力,可能會激發出更持久的通膨動能,而這是一個需要評估和管理的風險。一種可能是,勞工們因物價上漲而眼見實質收入下降,進而向雇主爭取並獲得更高的工資,從而引發不利的「工資—物價」螺旋式上升。不過,鑑於勞動市場並非特別緊俏,且正面的著日益增加的下行風險,這種結果似乎不太可能發生。

Another possibility is that inflation expectations could move up, dragging actual inflation with them. Inflation has been above our target for more than four years and remains a prominent concern for households and businesses. Measures of longer-term inflation expectations, however, as reflected in market- and survey-based measures, appear to remain well anchored and consistent with our longer-run inflation objective of 2 percent.

另一種可能性是通膨預期可能上揚,並連帶拉高實際的通膨。通膨率高於我們的目標已經超過四年,至今仍是家庭和企業的一個主要擔憂。然而,無論是從市場面還是調查面的數據來看,長期通膨預期的衡量指標似乎仍然穩定錨定,且與我們 2% 的長期通膨目標相符。

Of course, we cannot take the stability of inflation expectations for granted. Come what may, we will not allow a one-time increase in the price level to become an ongoing inflation problem.

當然,我們不能將通膨預期的穩定性視為理所當然。無論如何,我們絕不會允許一次性的物價水平上漲,演變成一個持續性的通膨問題。

Putting the pieces together, what are the implications for monetary policy? In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

綜合來看,這對貨幣政策有何意涵?短期內,通膨風險偏向上行,而就業風險偏向下行——這是一個充滿挑戰的局面。當我們的目標相互衝突時,我們的政策框架要求我們在雙重使命的兩端之間取得平衡。我們目前的政策利率比一年前更接近中性利率 100 個基點,而失業率及其他勞動市場指標的穩定性,讓我們在考慮調整政策立場時能夠謹慎行事。儘管如此,在政策處於限制性區間的情況下,基本的前景展望和不斷變化的風險平衡,可能使我們有理由調整政策立場。

Monetary policy is not on a preset course. FOMC members will make these decisions, based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach.

貨幣政策並沒有預設的路徑。聯邦公開市場委員會(FOMC)的成員將完全基於他們對數據的評估,以及數據對經濟前景和風險平衡的意涵,來做出這些決定。我們絕不會偏離這一原則。

Evolution of Monetary Policy Framework

Turning to my second topic, our monetary policy framework is built on the unchanging foundation of our mandate from Congress to foster maximum employment and stable prices for the American people. We remain fully committed to fulfilling our statutory mandate, and the revisions to our framework will support that mission across a broad range of economic conditions. Our revised Statement on Longer-Run Goals and Monetary Policy Strategy, which we refer to as our consensus statement, describes how we pursue our dual-mandate goals. It is designed to give the public a clear sense of how we think about monetary policy, and that understanding is important both for transparency and accountability, and for making monetary policy more effective.

接著談到我的第二個主題,我們的貨幣政策框架,是建立在國會賦予我們「為美國人民促進最大就業和物價穩定」這個不變的使命基礎之上。我們始終堅定地致力於履行我們的法定使命,而本次對框架的修訂,將有助於在各種廣泛的經濟狀況下支持這項使命的達成。我們修訂後的《長期目標與貨幣政策策略聲明》(我們稱之為「共識聲明」),闡述了我們如何追求雙重使命的目標。其目的在於讓大眾清楚地了解我們如何思考貨幣政策,而這種理解無論是對於透明度和問責制,還是對於提升貨幣政策的有效性而言,都至關重要。

The changes we made in this review are a natural progression, grounded in our ever-evolving understanding of our economy. We continue to build upon the initial consensus statement adopted in 2012 under Chair Ben Bernanke’s leadership. Today’s revised statement is the outcome of the second public review of our framework, which we conduct at five-year intervals. This year’s review included three elements: Fed Listens events at Reserve Banks around the country, a flagship research conference, and policymaker discussions and deliberations, supported by staff analysis, at a series of FOMC meetings.

我們在這次審查中所做的改變是一種自然的演進,其基礎是我們對經濟體不斷深化演變的理解。我們持續立基於前主席班・柏南奇(Ben Bernanke)領導下、於 2012 年所採納的最初共識聲明之上。今天這份修訂後的聲明,是我們第二次框架公開審查的成果,而這項審查我們每五年進行一次。今年的審查包含三個要素:在全國各地儲備銀行舉行的「聯準會傾聽」(Fed Listens)活動、一場指標性的研究會議,以及在一系列 FOMC 會議中,由幕僚研究分析支持的決策者討論與審議。

In approaching this year’s review, a key objective has been to make sure that our framework is suitable across a broad range of economic conditions. At the same time, the framework needs to evolve with changes in the structure of the economy and our understanding of those changes. The Great Depression presented different challenges from those of the Great Inflation and the Great Moderation, which in turn are different from the ones we face today.

在進行今年的審查時,一個關鍵目標始終是確保我們的框架能適用於各種廣泛的經濟狀況。與此同時,框架也需要隨著經濟結構的變化、以及我們對這些變化的理解而持續演進。「經濟大蕭條」時期所帶來的挑戰,與「大通膨」和「大溫和」時期的挑戰有所不同;而後兩者的挑戰,又與我們今日所面臨的截然不同。

At the time of the last review, we were living in a new normal, characterized by the proximity of interest rates to the effective lower bound (ELB), along with low growth, low inflation, and a very flat Phillips curve—meaning that inflation was not very responsive to slack in the economy. To me, a statistic that captures that era is that our policy rate was stuck at the ELB for seven long years following the onset of the Global Financial Crisis (GFC) in late 2008. Many here will recall the sluggish growth and painfully slow recovery of that era. It appeared highly likely that if the economy experienced even a mild downturn, our policy rate would be back at the ELB very quickly, probably for another extended period. Inflation and inflation expectations could then decline in a weak economy, raising real interest rates as nominal rates were pinned near zero. Higher real rates would further weigh on job growth and reinforce the downward pressure on inflation and inflation expectations, triggering an adverse dynamic.

在上次審查時,我們正處於一個「新常態」之中,其特徵是:利率逼近「有效利率下限」(ELB),伴隨著低增長、低通膨,以及一條非常平坦的菲利浦曲線——這意味著通膨對經濟中的閒置資源反應並不靈敏。對我而言,最能代表那個時代的一個數據就是:在 2008 年底全球金融危機(GFC)爆發後,我們的政策利率在有效利率下限(ELB)上,被困了整整七年。在座的許多人應該都還記得,那個時代增長的遲緩以及復甦的痛苦緩慢。當時看來極有可能,只要經濟遭遇哪怕是溫和的衰退,我們的政策利率就會很快回到有效利率下限,並且可能再次停留很長一段時間。在疲軟的經濟中,通膨和通膨預期就可能隨之下降,在名目利率被釘在接近零的水平時,這會反過來推高實質利率。而更高的實質利率會進一步拖累就業增長,並加劇通膨和通膨預期的下行壓力,從而觸發一種惡性循環。

The economic conditions that brought the policy rate to the ELB and drove the 2020 framework changes were thought to be rooted in slow-moving global factors that would persist for an extended period—and might well have done so, if not for the pandemic. The 2020 consensus statement included several features that addressed the ELB-related risks that had become increasingly prominent over the preceding two decades. We emphasized the importance of anchored longer-term inflation expectations to support both our price-stability and maximum-employment goals. Drawing on an extensive literature on strategies to mitigate risks associated with the ELB, we adopted flexible average inflation targeting—a “makeup” strategy to ensure that inflation expectations would remain well anchored even with the ELB constraint. In particular, we said that, following periods when inflation had been running persistently below 2 percent, appropriate monetary policy would likely aim to achieve inflation moderately above 2 percent for some time.

當時,人們普遍認為,將政策利率推向有效利率下限(ELB)並促成 2020 年框架變革的經濟狀況,是源於一些會長期持續、變動緩慢的全球性因素——而且,若不是因為全球疫情大流行,情況很可能真的會是如此。2020 年的共識聲明包含了幾項特點,用以應對在過去二十年間日益突出的、與 ELB 相關的風險。我們強調,錨定穩固的長期通膨預期,對於支持物價穩定和最大就業這兩大目標至關重要。在借鑒大量關於減輕 ELB 相關風險策略的文獻後,我們採納了「彈性平均通膨目標制」(flexible average inflation targeting)——這是一種「彌補」策略,旨在確保即使在面臨 ELB 的約束時,通膨預期仍能維持穩定錨定。我們特別指出,在通膨率持續低於 2% 的時期過後,適當的貨幣政策可能會致力於在一段時間內,讓通膨率達到適度高於 2% 的水平。

In the event, rather than low inflation and the ELB, the post-pandemic reopening brought the highest inflation in 40 years to economies around the world. Like most other central banks and private-sector analysts, through year-end 2021 we thought that inflation would subside fairly quickly without a sharp tightening in our policy stance (figure 5). When it became clear that this was not the case, we responded forcefully, raising our policy rate by 5.25 percentage points over 16 months. That action, combined with the unwinding of pandemic supply disruptions, contributed to inflation moving much closer to our target without the painful rise in unemployment that has accompanied previous efforts to counter high inflation.

但實際發生的情況是,出現的並不是低通膨和有效利率下限(ELB)的問題,反而是疫情後的經濟重啟,為全球經濟體帶來了四十年來最高的通膨。如同大多數其他央行和私部門的分析師一樣,在 2021 年底之前,我們曾認為通膨會相當快地消退,並不需要我們大幅收緊政策立場。當情況顯然並非如此時,我們採取了果斷有力的應對措施,在 16 個月內將政策利率提高了 5.25 個百分點。這項行動,加上疫情期間供應鏈中斷問題的緩解,共同促使通膨大幅朝我們的目標靠近,同時避免了過去在對抗高通膨時,時常伴隨而來的失業率痛苦攀升的問題。

Elements of the Revised Consensus Statement

This year’s review considered how economic conditions have evolved over the past five years. During this period, we saw that the inflation situation can change rapidly in the face of large shocks. In addition, interest rates are now substantially higher than was the case during the era between the GFC and the pandemic. With inflation above target, our policy rate is restrictive—modestly so, in my view. We cannot say for certain where rates will settle out over the longer run, but their neutral level may now be higher than during the 2010s, reflecting changes in productivity, demographics, fiscal policy, and other factors that affect the balance between saving and investment (figure 6). During the review, we discussed how the 2020 statement’s focus on the ELB may have complicated communications about our response to high inflation. We concluded that the emphasis on an overly specific set of economic conditions may have led to some confusion, and, as a result, we made several important changes to the consensus statement to reflect that insight.

今年的審查,考量了過去五年經濟狀況的演變。在此期間,我們看到在面臨巨大衝擊時,通膨情勢是可能迅速改變的。此外,目前的利率水平,已實質上高於全球金融危機(GFC)與疫情大流行之間那個時代的水平。在通膨高於目標的情況下,我們的政策利率是具有限制性的——在我看來,是一種溫和的限制性。我們無法肯定地說長期利率最終會穩定在哪個水平,但利率的中性水平現在可能已高於 2010 年代,這反映了生產力、人口結構、財政政策,以及其他影響儲蓄與投資平衡因素的變化。在審查期間,我們討論到 2020 年的聲明過於聚焦在有效利率下限(ELB)上,這可能使我們在應對高通膨時的對外溝通變得複雜化。我們得出的結論是,過度強調一組太過特定的經濟狀況可能已經導致了一些混淆,因此,我們對共識聲明做出了幾項重要修改,以反映這一見解。

First, we removed language indicating that the ELB was a defining feature of the economic landscape. Instead, we noted that our “monetary policy strategy is designed to promote maximum employment and stable prices across a broad range of economic conditions.” The difficulty of operating near the ELB remains a potential concern, but it is not our primary focus. The revised statement reiterates that the Committee is prepared to use its full range of tools to achieve its maximum-employment and price-stability goals, particularly if the federal funds rate is constrained by the ELB.

首先,我們刪除了暗示有效利率下限(ELB)是經濟格局決定性特徵的相關表述。我們轉而指出,我們的「貨幣政策策略旨在促進在各種廣泛經濟狀況下的最大就業和物價穩定」。在接近 ELB 的環境下運作的困難仍然是一個潛在的考量,但已不再是我們的首要焦點。修訂後的聲明重申,委員會準備好運用其所有工具,以達成最大就業和物價穩定的目標,特別是在聯邦資金利率受到 ELB 約束的情況下。

Second, we returned to a framework of flexible inflation targeting and eliminated the “makeup” strategy. As it turned out, the idea of an intentional, moderate inflation overshoot had proved irrelevant. There was nothing intentional or moderate about the inflation that arrived a few months after we announced our 2020 changes to the consensus statement, as I acknowledged publicly in 2021.

第二,我們回歸到「彈性通膨目標制」的框架,並取消了「彌補」策略。事實證明,刻意讓通膨適度超標的想法,已變得毫無意義。正如我本人在 2021 年曾公開承認的,在我們 2020 年宣布修改共識聲明後幾個月到來的那波通膨,絕非刻意,也毫不溫和。

Well-anchored inflation expectations were critical to our success in bringing down inflation without a sharp increase in unemployment. Anchored expectations promote the return of inflation to target when adverse shocks drive inflation higher, and limit the risk of deflation when the economy weakens. Further, they allow monetary policy to support maximum employment in economic downturns without compromising price stability. Our revised statement emphasizes our commitment to act forcefully to ensure that longer-term inflation expectations remain well anchored, to the benefit of both sides of our dual mandate. It also notes that “price stability is essential for a sound and stable economy and supports the well-being of all Americans.” This theme came through loud and clear at our Fed Listens events. The past five years have been a painful reminder of the hardship that high inflation imposes, especially on those least able to meet the higher costs of necessities.

穩定錨定的通膨預期,是我們能在壓低通膨的同時,又避免失業率大幅攀升的成功關鍵。在不利衝擊推高通膨時,錨定的預期有助於通膨回歸目標水平;在經濟疲軟時,它又能限制通貨緊縮的風險。此外,它們讓貨幣政策能夠在經濟衰退期間支持最大就業,同時不損害物價穩定。我們修訂後的聲明強調,我們承諾將採取有力行動,確保長期通膨預期維持穩定錨定,因為這對我們雙重使命的兩端都有利。聲明中也指出:「物價穩定是健全穩定經濟的基石,並支持著所有美國人的福祉。」這個主旨也在我們的「聯準會傾聽」(Fed Listens)活動中,得到了清晰而響亮的體現。過去五年是一個痛苦的提醒,讓我們意識到高通膨所造成的艱難困苦,尤其是對那些最難以負擔生活必需品高昂成本的人們而言,更是如此。

Third, our 2020 statement said that we would mitigate “shortfalls,” rather than “deviations,” from maximum employment. The use of “shortfalls” reflected the insight that our real-time assessments of the natural rate of unemployment—and hence of “maximum employment”—are highly uncertain. The later years of the post-GFC recovery featured employment running for an extended period above mainstream estimates of its sustainable level, along with inflation running persistently below our 2 percent target. In the absence of inflationary pressures, it might not be necessary to tighten policy based solely on uncertain real-time estimates of the natural rate of unemployment.

第三,我們 2020 年的聲明曾指出,我們將致力於減輕(mitigate)就業相對於充分就業的「缺口」(shortfalls),而非「偏離」(deviations)。使用「缺口」一詞,反映了一種見解:我們對自然失業率——並引申為對「最大就業」——的即時評估,是高度不確定的。在全球金融危機(GFC)後復甦的後期,我們看到就業水平在很長一段時間內,都高於主流觀點對其可持續水平的預估;與此同時,通膨率卻持續低於我們 2% 的目標。在沒有通膨壓力的情況下,或許沒有必要僅僅因為對自然失業率不確定的即時評估,就收緊貨幣政策。

We still have that view, but our use of the term “shortfalls” was not always interpreted as intended, raising communications challenges. In particular, the use of “shortfalls” was not intended as a commitment to permanently forswear preemption or to ignore labor market tightness. Accordingly, we removed “shortfalls” from our statement. Instead, the revised document now states more precisely that “the Committee recognizes that employment may at times run above real-time assessments of maximum employment without necessarily creating risks to price stability.” Of course, preemptive action would likely be warranted if tightness in the labor market or other factors pose risks to price stability.

我們仍然抱持那樣的觀點,但我們對「缺口」一詞的使用,並未總是如我們預期的那樣被解讀,從而帶來了溝通上的挑戰。具體來說,使用「缺口」一詞,其本意並非承諾要永久放棄採取預防性行動,也不是要忽視勞動市場的緊俏狀況。因此,我們從聲明中移除了「缺口」這個詞。取而代之的是,修訂後的文件現在更精確地陳述:「委員會認識到,就業水平有時可能會高於對最大就業水平的即時評估,而不必然會對物價穩定構成風險。」當然,如果勞動市場的緊俏狀況或其他因素對物價穩定構成風險,那麼採取預防性行動很可能就是合理的。

The revised statement also notes that maximum employment is “the highest level of employment that can be achieved on a sustained basis in a context of price stability.” This focus on promoting a strong labor market underscores the principle that “durably achieving maximum employment fosters broad-based economic opportunities and benefits for all Americans.” The feedback we received at Fed Listens events reinforced the value of a strong labor market for American households, employers, and communities.

修訂後的聲明也指出,最大就業是「在物價穩定的前提下,可持續達成的最高就業水平」。這種對促進強勁勞動市場的關注,強調了一項原則:「持久地達成最大就業,能為所有美國人創造基礎廣泛的經濟機會與福祉。」我們在「聯準會傾聽」(Fed Listens)活動中收到的回饋,再次印證了強勁勞動市場對於美國家庭、雇主和社區的價值。

Fourth, consistent with the removal of “shortfalls,” we made changes to clarify our approach in periods when our employment and inflation objectives are not complementary. In those circumstances, we will follow a balanced approach in promoting them. The revised statement now more closely aligns with the original 2012 language. We take into account the extent of departures from our goals and the potentially different time horizons over which each is projected to return to a level consistent with our dual mandate. These principles guide our policy decisions today, as they did over the 2022–24 period, when the departure from our 2 percent inflation target was the overriding concern.

第四,與移除「缺口」一詞的作法一致,我們也修改了聲明,以釐清當就業與通膨目標相互衝突時我們的應對方針。在那些情況下,我們將採取「平衡的方法」(balanced approach)來促進這兩大目標的達成。修訂後的聲明,現在與 2012 年的初始版本表述更為貼近。我們會考量各項目標偏離的程度,以及預計它們各自需要花費多久的時間,才能回歸到與我們雙重使命相符的水平。這些原則指導著我們今日的政策決定,一如它們在 2022 至 2024 年期間所發揮的作用;當時,偏離 2% 通膨目標的問題,正是我們壓倒性的首要考量。

In addition to these changes, there is a great deal of continuity with past statements. The document continues to explain how we interpret the mandate Congress has given us and describes the policy framework that we believe will best promote maximum employment and price stability. We continue to believe that monetary policy must be forward looking and consider the lags in its effects on the economy. For this reason, our policy actions depend on the economic outlook and the balance of risks to that outlook. We continue to believe that setting a numerical goal for employment is unwise, because the maximum level of employment is not directly measurable and changes over time for reasons unrelated to monetary policy.

除了上述這些改變之外,新的聲明與過去的版本仍有很大程度的延續性。這份文件持續解釋我們如何詮釋國會所賦予的使命,並闡述了我們相信最能促進最大就業和物價穩定的政策框架。我們仍然相信,貨幣政策必須具有前瞻性,並且必須考量其政策效果對經濟影響的滯後性。基於這個理由,我們的政策行動取決於經濟展望,以及環繞著該展望的風險平衡。我們也仍然認為,為就業設定一個具體的數值目標是不明智的,因為最大就業水平不僅無法被直接衡量,而且還會因為與貨幣政策無關的因素隨時間而改變。

We also continue to view a longer-run inflation rate of 2 percent as most consistent with our dual-mandate goals. We believe that our commitment to this target is a key factor helping keep longer-term inflation expectations well anchored. Experience has shown that 2 percent inflation is low enough to ensure that inflation is not a concern in household and business decisionmaking while also providing a central bank with some policy flexibility to provide accommodation during economic downturns.

我們也持續認為,2% 的長期通膨率最符合我們的雙重使命目標。我們相信,我們對此一目標的承諾,是協助長期通膨預期維持穩定錨定的一個關鍵因素。經驗表明,2% 的通膨率夠低,足以確保通膨不會成為家庭和企業決策時的一項主要考量;同時,它也為央行提供了一定的政策彈性,以便在經濟衰退期間提供寬鬆支持。

Finally, the revised consensus statement retained our commitment to conduct a public review roughly every five years. There is nothing magic about a five-year pace. That frequency allows policymakers to reassess structural features of the economy and to engage with the public, practitioners, and academics on the performance of our framework. It is also consistent with several global peers.

最後,修訂後的共識聲明保留了我們大約每五年進行一次公開審查的承諾。五年一次的頻率並沒有什麼神奇之處。這個頻率讓決策者們能夠重新評估經濟的結構性特徵,並與公眾、實務界人士及學者,就我們框架的表現進行交流。這也與其他幾個全球主要央行的做法一致。

Conclusion

In closing, I want to thank President Schmid and all his staff who work so diligently to host this outstanding event annually. Counting a couple of virtual appearances during the pandemic, this is the eighth time I have had the honor to speak from this podium. Each year, this symposium offers the opportunity for Federal Reserve leaders to hear ideas from leading economic thinkers and focus on the challenges we face. The Kansas City Fed was wise to lure Chair Volcker to this national park more than 40 years ago, and I am proud to be part of that tradition.

在演說的最後,我想感謝施密德總裁(President Schmid)以及他所有辛勤努力的同仁,每年都為我們舉辦這場傑出的盛會。如果算上疫情期間的幾次線上參與,這已經是我第八次榮幸地站上這個講台發表演說。每一年,這場研討會都提供了一個機會,讓聯準會的領導層得以聆聽頂尖經濟思想家的見解,並專注於我們所面臨的挑戰。堪薩斯市聯邦儲備銀行在四十多年前,明智地吸引了當時的主席伏克爾(Volcker)來到這座國家公園,我很榮幸能成為這項傳統的一部分。